Post WIP Disbursements

The Post Disbursements routine allows the user to enter and post disbursements to the General Ledger. In E-Quinox, Disbursements are any expense to the Firm acquired through work for a Client. For example, Long Distance Phone Calls, Postage Charges, Photocopy Charges. These costs are usually charged to the Client. Disbursements are sometimes broken down into Sundry Disbursements/Soft Costs (Firm Expenses), and General Disbursements/Hard Costs (General Expenses, usually paid for by Cheque).

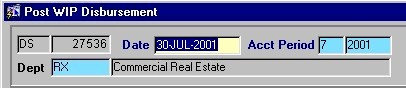

When the Post Disbursements routine is accessed from the eQuinox main menu, the screen shown below will be displayed.

Field Definition

The first two fields on this screen display the Journal Type (DS) and the Journal Number (27536).

Date - The date on which the Disbursements are being posted. This field automatically defaults to the current system date.

Acct Period - The Month (in number format) and Year of the Firm's current Accounting Period. This field automatically defaults to the current Accounting Period. Note: Depending on the Firm's preferences (as indicated in the Firm Parameters routine), the user may be alerted with a message when moving to the next section of the screen, and asked to verify the Accounting Period; this is used to ensure that all transactions occur within the correct Accounting Period.

Dept - This field automatically defaults to the Department with which the current user is associated (identified when the user logs into the system). If necessary, this can be changed by making a selection from the List of Values provided.

Batch - The total amount (in dollars) of Disbursements to be entered in the current Journal. If known, this number may be entered when the Journal is started, or when posting the Journal.

Proof - The amount of the 'Batch' that has yet to be applied (i.e. the Batch amount minus the actual amount of Disbursements currently in the Journal). Note: The Work In Progress Disbursements cannot be posted until the Proof amount reaches zero.

Expense

The Expense section of the screen displays information pertaining to General Expense Disbursements (also known as General Disbursements or Hard Costs). Each Disbursement record includes information about the Client that will be billed for the expense.

C/G - The value entered in this field determines whether the current record is a client expense or a firm expense. For a client expense record, the user must enter "C"; for a firm expense record, the user must enter "G". If the user enters "G", they will automatically be taken to the Firm Expense section of the screen.

Client - The unique identifier of the Client who will be billed for the current Disbursement (i.e. the expense was acquired through work for this Client). When entering new records, a selection may be made from the Look-Up form provided in the Matter field (will display all Clients, and all Matters associated with each Client). The Client Name is displayed below (i.e. "PHAN, THI").

Matter - The unique identifier of the Matter associated with the Client being billed for the current Disbursement (i.e. the expense was acquired through work on this specific Matter). A selection may be made from the Look-Up form provided. The Matter Name is displayed below (i.e. "PT real estate").

Task - The Task Code associated with the current Disbursement record. Task Codes identify the type of activity through which the Disbursement Cost occurred. When entering new records, a selection may be made from the List of Values provided.

Tmkp - The unique identifier of the Timekeeper associated with the current Disbursement (i.e. usually the Timekeeper who is responsible for the Matter). When entering new records, a selection may be made from the List of Values provided. The Timekeeper Name is displayed below (i.e. "BIGGS, FRANK").

Tran Date - The date on which the Disbursement expense was acquired by the Firm. When entering new records, a selection may be made from the Calendar provided. If the user tabs through this field without entering a value, it automatically defaults to the current system date.

PB - The value displayed in this field indicates whether or not the current record is a priority bill (i.e. "Y" indicates Yes, "N" indicates No). When entering new records, this field defaults to "N". To change this, the user must manually enter "Y".

Code, Description - The code and description of the Disbursement through which the Client Expense portion of the Disbursement expense was incurred. A selection may be made from the List of Values provided.

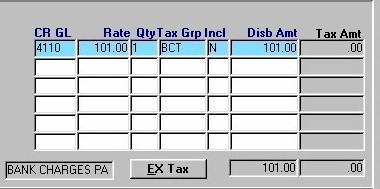

CR GL - The number of the GL Account that will be credited when the current transaction is posted. The corresponding GL Account Name is displayed below this field (i.e. "Bank Charges Payable").

Rate - The amount charged for one unit or occurrence of the current type of Disbursement. This field is automatically filled with the proper information when a selection is made from the Disbursement List of Values.

Qnt - The quantity or number of occurrences of the current Disbursement. If the user tabs through this field without entering a value, it will automatically default to '1'.

Tax Grp - The tax group applied to the current Client Expense Disbursement amount. A selection may be made from the List of Values provided.

Incl - The Yes/No value of this field indicates whether or not the Tax Amount is to be included in the amount charged for the current Client Expense Disbursement. When entering new records, this field defaults to "N" (No). To change this, the user must manually enter "Y".

Disb Amt - The total amount being charged to the Client for the current Client Expense Disbursement. A running total of the disbursement amount for all Client Expense records entered is displayed below this field.

Tax Amt - The amount of Tax that is to be charged for the current Client Expense Disbursement. This amount is calculated based on the Rate, Quantity, and the rate of the Tax Group being applied. A running total of the tax amount for all Client Expense records entered is displayed below this field.

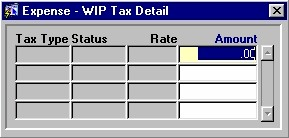

EX Tax - When the user clicks this button, they are presented with the window seen below (Expense - WIP Tax Detail). This allows the user to verify the tax information for the current record.

Tax Type - The type of Tax applied to the current Client Disbursement.

Status - The status of the Tax Type (i.e. Taxable, Exempt).

Rate - The rate at which Tax is charged for the current Tax Type.

Amount - The dollar amount of Tax charged for the current Client Disbursement.

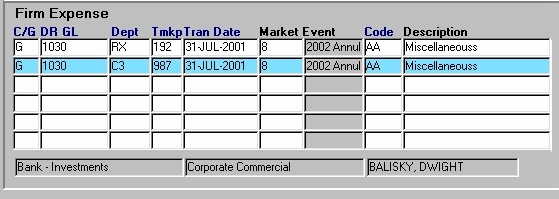

Firm Expense

This section of the screen displays information pertaining to Firm Expense Disbursements (also known as Sundry Disbursements or Soft Costs).

C/G - The value entered in this field determines whether the current record is a client expense or a firm expense. For a client expense record, the user must enter "C"; for a firm expense record, the user must enter "G". If the user enters "C", they will automatically be taken to the Client Expense section of the screen.

DR GL - The General Ledger Account that is to be Debited during the current Disbursement Transaction. When entering new records, a selection may be made from the List of Values provided. The Account Number is displayed in this field and the Account Name is displayed below (i.e. "Bank - Investments").

The unique identifier for the Department associated with the current Disbursement (i.e. the department within which the expense was acquired). This field automatically defaults to the Department/Office indicated by the Department field in the first section of the screen. If necessary, this value may be changed by making a selection from the List of Values provided. The Department Name is displayed below (i.e. "Corporate Commercial").

Tmkp - The unique identifier for the Timekeeper associated with the current Disbursement. When entering new records, a selection may be made from the List of Values provided. The Timekeeper Name is displayed below (i.e. "BALISKY, DWIGHT").

Tran Date - The date on which the Disbursement expense was acquired by the Firm. When entering new records, a selection may be made from the Calendar provided. If the user tabs through this field without entering a value, it automatically defaults to the current system date.

Market Event - The marketing event, if any, that is associated with the current Firm Expense record. A selection may be made from the List of Values provided.

Code, Description - The code and description of the Disbursement through which the Firm Expense portion of the expense was incurred. A selection may be made from the List of Values provided.

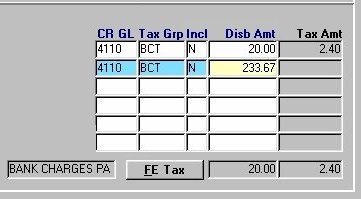

CR GL - The number of the GL Account that will be credited when the current transaction is posted. The corresponding GL Account Name is displayed below this field (i.e. "Bank Charges Payable").

Tax Grp - The tax group applied to the current Firm Expense Disbursement amount. A selection may be made from the List of Values provided.

Incl - The Yes/No value of this field indicates whether or not the Tax Amount is to be included in the amount charged for the current Firm Expense Disbursement. When entering new records, this field defaults to "N" (No). To change this, the user must manually enter "Y".

Disb Amt - The total cost to the Firm for the current Firm Expense Disbursement. A running total of disbursement amounts for all Firm Expense records entered is displayed below this field.

Tax Amt - The amount of Tax that is to be charged for the current Firm Expense Disbursement. A running total of the tax amount for all Firm Expense records entered is displayed below this field.

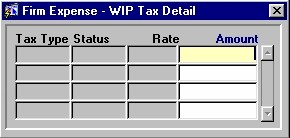

FE Tax - When the user clicks this button, they are presented with the window seen below (Firm Expense - WIP Tax Detail). This allows the user to verify the tax information for the current record.

Tax Type - The type of Tax applied to the current Firm Expense Disbursement.

Status - The status of the Tax Type (i.e. Taxable, Exempt).

Rate - The rate at which Tax is charged for the current Tax Type.

Amount - The dollar amount of Tax charged for the current Firm Expense Disbursement.

To post a Batch of Disbursements, the user must click the Save button (or press F10). When the Disbursements are successfully posted, the user will be presented with the message seen on the left.